how to determine tax bracket per paycheck

Ad Compare Your 2022 Tax Bracket vs. The first 9950 is taxed at 10 995.

Enter your tax year filing status and taxable income to calculate your estimated tax rate.

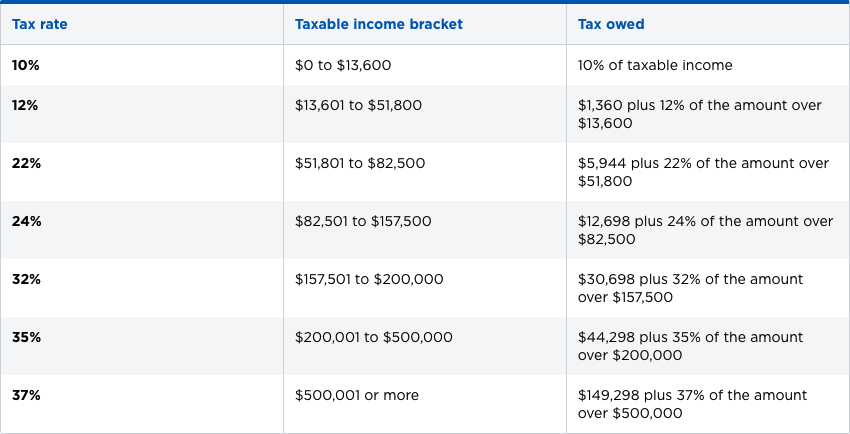

. First bracket taxation 0-9875 A tax rate of 10 gives us 10 X 9875 9875 Second bracket taxation 9 876-40 125 A tax rate of 12 gives us 40125 minus 9876 30249 Therefore 12 X 30 249 362988 Third bracket taxation 40 126- 50 000 income limit A tax rate of 22 gives us 50 000 minus 40 126 9 874. You can find the amount of federal income tax withheld on your paycheck stub. For example in 2021 a single filer with taxable income of 100000 will pay 18021 in tax or an average tax rate of 18.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. The rest of your income is in the next bracket and is taxed 22. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

The next 30575 is taxed at 12 3669. 2021-2022 federal income tax brackets rates for taxes due April 15 2022. Repeat that step for the next bracket and continue until you reach your bracket.

But your marginal tax rate or tax bracket is actually 24. 10 12 22 24 32 35 and 37. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice.

Since tax brackets are determined based on your taxable income its your taxable income you need to manage. In the US income tax system income tax rates are graduated. For Example For example a single taxpayer will pay 10 percent on taxable income up to 10275 earned in 2022.

Up to 65000 that would be 561528. The formula in G5 is. Average tax rate Total taxes paid Total taxable income However your marginal federal tax rate is 205 percentthats the tax rate you pay on anything you earn beyond your current earnings.

Wage bracket method If you use the wage bracket method find the range the employees wages fall under ie At least X But less than X. Get Your Max Refund Today. These are the rates for taxes due.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Ready to get your tax withholding back on track.

How to Calculate and Adjust Your Tax Withholding. On 50000 taxable income the average federal tax rate is 1510 percentthats your total income divided by the total tax you pay. Total Estimated Tax Burden.

For example if you earned 100000 and claim 15000 in deductions then your taxable income is 85000. The last 5244 is taxed at 22 115. Discover Helpful Information and Resources on Taxes From AARP.

Add the taxes from each bracket together to. Convert assets to Roth accounts. 0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401.

Multiply the rate by the maximum amount of income for that bracket. Your bracket depends on your taxable income and filing status. Total Up Your Tax Withholding.

Income tax bracket calculation Summary To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example. Percent of income to taxes. Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to.

Once under the ordinary income tax system and again under the AMT. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Graduated means you pay different percentage of you income in taxes when you reach a certain income.

AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Your taxable income is the amount used to determine which tax brackets you fall into.

VLOOKUP inc rates31 inc - VLOOKUP inc rates11. Lets start by adding up your expected tax withholding for the year. Next compare your taxable income to the tax brackets and rates for the year which can be found in Table 1 on this page of the Tax Foundations website.

Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your 2021 Tax Bracket to See Whats Been Adjusted.

For 2020 look at line 10 of your Form 1040 to find your taxable income. Manage your taxable income. The next bracket is 9701-39475 and it is taxed 12 to give us an additional 357288.

Then using the information the employee entered on Form W-4 eg standard withholding or withholding based on adjustments find the amount to withhold. Gather information for other sources of income you may have. That 85000 happens to fall into the first four of the seven tax brackets meaning that portions of it are taxed at different rates.

How to Control Your Tax Bracket in Retirement. If you increase your contributions your paychecks will get smaller. Based on your taxable income and filing.

Keep in mind that the Tax Withholding Estimators results will only be as accurate as the information you enter. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower. Gather the most recent pay statements for yourself and if you are married for your spouse too.

Your household income location filing status and number of personal exemptions. Have your most recent income tax return handy. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

To calculate how much you owe in taxes start with the lowest bracket. How the US Tax Brackets work. There are seven federal tax brackets for the 2021 tax year.

0 taxes on long-term capital.

Missouri Income Tax Rate And Brackets H R Block

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Here S How Rising Inflation May Affect Your 2021 Tax Bill

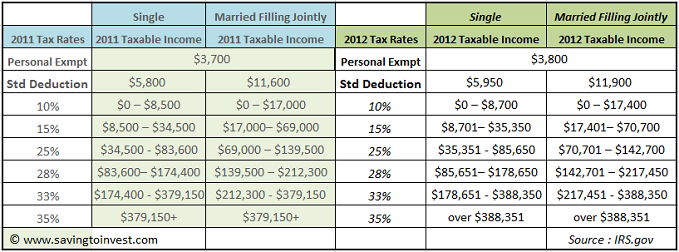

Tax Brackets And Federal Irs Rates Standard Deduction And Personal Exemptions Aving To Invest

Federal Income Tax Brackets Brilliant Tax

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Tax Inflation Adjustments Released By Irs

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Oc Fed Income Tax Brackets Breakdown R Dataisbeautiful

How Do Marginal Income Tax Rates Work And What If We Increased Them

Federal Income Tax Brackets Brilliant Tax

How Much Does A Small Business Pay In Taxes

How Do Tax Brackets Actually Work Youtube

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Brackets Brilliant Tax

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management